On a warm summer’s day this May, I found myself standing in Washington Square Park telling a crowd of strangers something that I’ve never told any of my friends or colleagues. I’m an apparently successful New York professional type. And I’m way in debt. Credit cards and mortgage. The appurtenances of the career, travel to conferences and the like, combined with falling for the housing hype, mean that in all likelihood my finances will balance only when I die. It was a very emotional moment. It’s a Strike Debt Assembly and it’s become the basis of a new political movement.

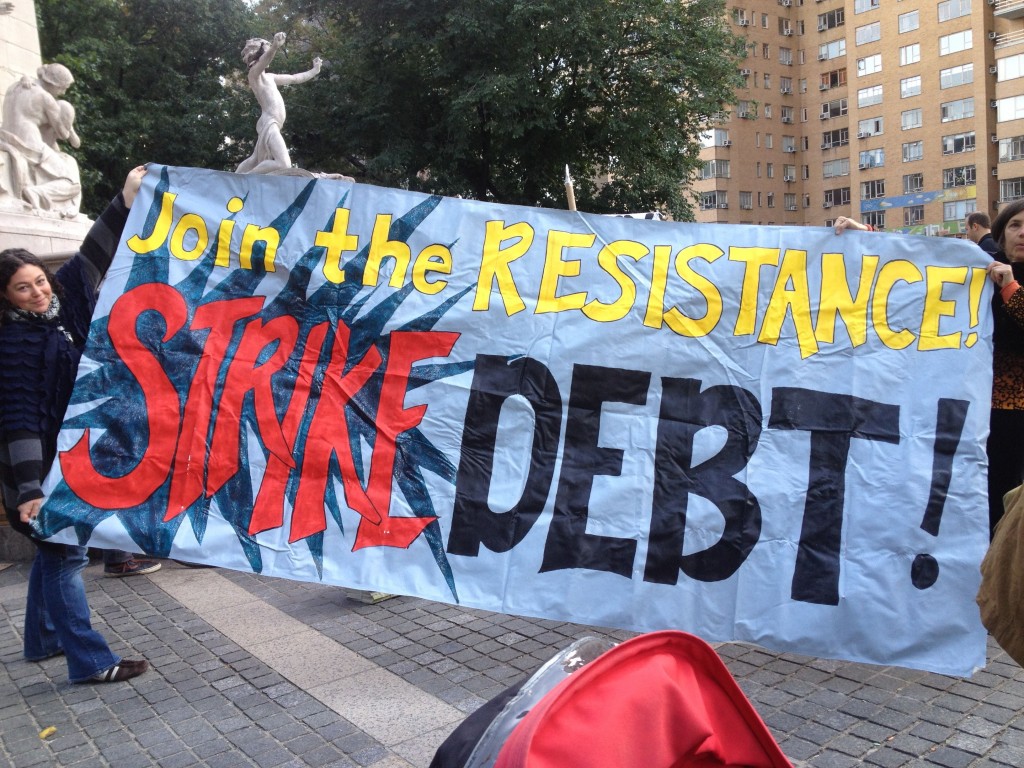

Strike Debt is an offshoot of Occupy Wall Street. We think of debt as the tie that binds the 99%, whereas for the one per cent it’s just another way to make money. From the assemblies around New York, Strike Debt has developed affiliates in Berkeley, Boston, Chicago, Los Angeles, Portland, Tampa and even the United Kingdom to name just a few. The campaign isn’t six months old yet. I’ve been in a play, given talks, been hoisted on a fellow campaigner’s shoulders outside the Plaza Hotel, done jail support, casseroled, researched, written, attended dozens of meetings and read more emails than you would believe possible.

All of this has happened because people spontaneously and clearly understand the way that debt has become a system of domination. There are reams of statistics but few come to Strike Debt looking to be convinced. They want to resist. Many are resisting already. The movement gained impetus from the passionate debt resistance in Montréal, making red squares and casserole marches the early features of Strike Debt.

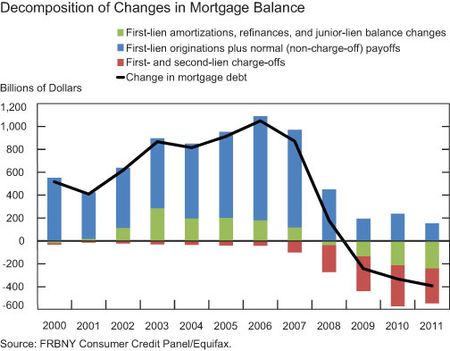

But we’ve learned an enormous amount about debt and how it works. The key revelation for me is that debt is how the present financial system creates money. This is why a lender can make a profit, even if a borrower defaults on 90% of their loan, because that 10% is money that did not exist before. In short, none of this is real. In nineteenth century terminology, debt is a phantasmagoria, translated today into zombie capitalism.

Over the summer, a plan of action came together that we have put into practice. The Debt Resistors Operations Manual was collectively written and produced in six weeks, giving debtors key information about how to understand, negotiate and ultimately resist their debt. The Manual, usually known as the DROM in the campaign, made Strike Debt seem real and significant. In a purportedly digital age, there’s still nothing to beat placing a book in someone’s hands: for free.

The debt assembly became the debt burn: people would speak about their debt, as I did, and then burn it, using a bill or invoice. This gesture is powerfully cathartic and radicalizing. It set the way for two days of direct action, known in movement parlance as S17 and O13. September 17 was the first anniversary of Occupy Wall Street. Strike Debt organized the debt zone of the storm around Wall Street and held empowering actions in and around JP Morgan Chase, Citibank, Emblem Health, Standard and Poor’s and other key institutions of the debt system.

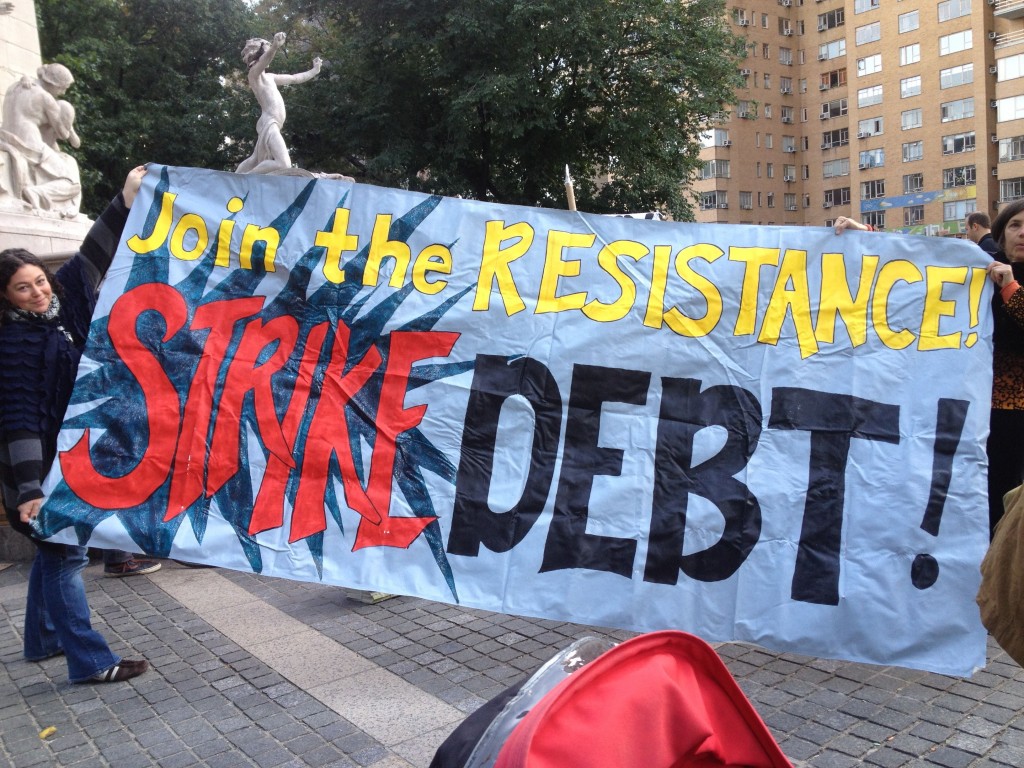

October 13 was a global day of noise in which a key theme for European participants was debt resistance. Strike Debt put out a joint statement with Réelle Démocratie Maintenant (Paris), Auditoria Ciudadana de la Deuda (Spain/15M), and the Global Spring (Portugal):

To the financial institutions of the world, we have only one thing to say: we owe you NOTHING!

To our friends, families, our communities, to humanity and to the natural world that makes our lives possible, we owe you everything.

To the people of the world, we say: join the resistance, you have nothing to lose but your debts.

The statement was mic checked in French at Columbus Circle before we dispersed to reassemble outside the residence of Lloyd Blankfein, CEO of Goldman Sachs, where another statement was read. Occupy Goldman Sachs is still there, reminding everyone why this movement exists in the first place. The international dimension to the campaign is crucial as we move forward and the Europe-wide 99 Agora meeting in Madrid this November made debt one of its key themes.

In the wake of Hurricane Sandy, as the floodwaters recede, the moral high ground has been occupied by a revived social movement. Occupy Sandy and Strike Debt together understand the debt system and the climate disaster to be different aspects of the same issue. The reason is simple. In order to “pay back” purported “debt,” it is necessary to increase the size of the economy. Presently, that cannot be done without increasing carbon and other toxic emissions. Whether the goal is that industrialized world pays its climate debt to the rest of human and non-human life, or that there be a debt abolition for the 99% in the same way that the banks were bailed out, the target is the same: fossil-fuel burning, debt-driven capitalism.

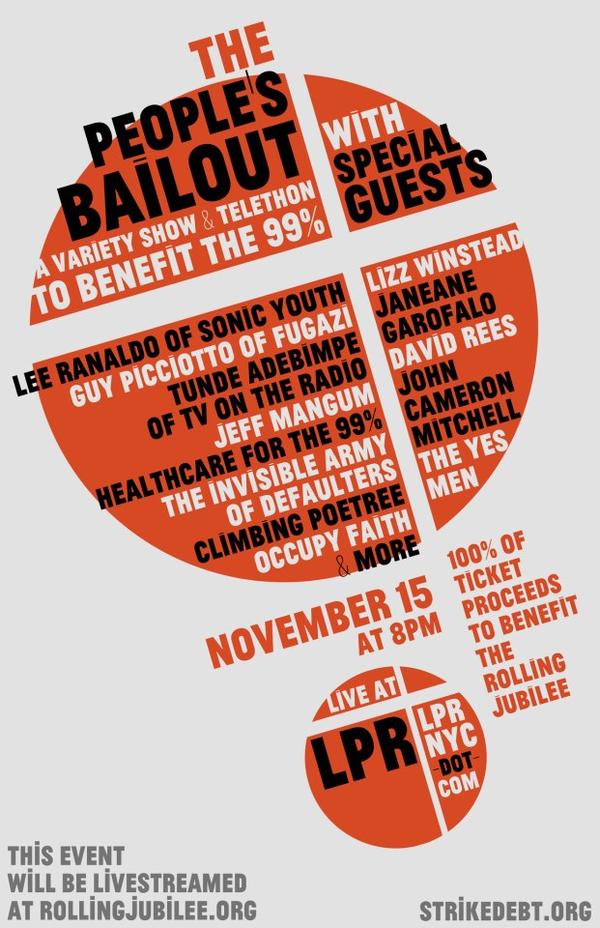

I’m writing on the cusp of what will be the finest hour yet for Strike Debt, the People’s Bailout. Early on we realized that a tacky market exists in which debt buyers purchase defaulted or past due debt from lenders for pennies on the dollar. We wondered whether we could do the same thing but instead of trying to collect the debt, abolish it. Into one of the assemblies walks an activist who has been planning just that. The final inspiration was to hold a Telethon, a live benefit, to raise the money. The overall project was called The Rolling Jubilee, in honor of the ancient concept of debt abolition as a jubilee. We crowd sourced a little money and tried it out. It worked.

On November 15, the anniversary of the eviction of Occupy Wall Street, the People’s Bailout will demonstrate how mutual aid isn’t just a nice idea but a radical tool for empowerment. For each $50,000 we collect, no less than $1 million of debt will be abolished. I’m amazed to write it like this because we had hoped—wildly, we thought—to raise $50,000 total. As of Thursday afternoon, over $200,000 has already been donated, which will abolish over $4 million of debt.

Let me say that we get that this does not abolish capitalism. But like everything else that Strike Debt has done, it’s exciting, empowering and different. It’s not just another march, petition or slogan. It does something that makes a difference.

Like this:

Like Loading...