My country of origin, the UK, is about to make a global fool of itself over the monarch’s so-called diamond jubilee, commemorating the apparently endless “reign” of Elizabeth Windsor. Altogether forgotten in all this noise has been the devastating report of the Jubilee Debt Campaign, which shows the much better side of the country. Established in 2000, the campaign has had some success in debt cancellation. Now it reports that things are getting worse.

Once again, then: No to a royal jubilee and yes to a global debt jubilee.

Once again, then: No to a royal jubilee and yes to a global debt jubilee.

The key facts from the report make the case for debt abolition in themselves:

In the 1950s and 1960s the number of governments defaulting on their debts averaged four every twenty years. Since the 1970s this has risen to four every year….

The current First World Debt Crisis has led to debts in impoverished countries increasing. Their government foreign debt payments will increase by one-third over the next few years.

The Mozambique, Ethiopia and Niger governments could be spending as much on foreign debt payments in a few years as they were before debt relief.

These are countries where the Gross National Income–which is not what the average person earns but an estimate based on all final goods and services–is less than $1005 per person per annum. Even a High Income country averages only $12,276 or more. Compare that to the high-rollers on Wall Street.

A 2011 research paper for that well-known left organization the Bank of England demonstrated that, compared to the Bretton Woods system:

The current system has coexisted, on average, with: slower, more volatile, global growth; more frequent economic downturns; higher inflation and inflation volatility, larger current account imbalances; and more frequent banking crises, currency crises and external defaults.

In short: neo-liberalism is a disaster for everyone except creditors. The rhetoric of the one percent used by Occupy is more or less accurate in fact as well as emotional force.

Debts need to be cancelled. The Jubilee campaign has some practical suggestions to this end. They call for a system of debt audit and an international debt court with powers to arbitrate between creditors and debtors and/or cancel debt as they see fit.

However, in 2011 the IMF and the World Bank brought to an end the Heavily Indebted Poor Countries initiative, the sole international system for dealing with debt crisis, having given “aid” to only 32 countries in 17 years. Some countries ended up spending more on debt repayment after involvement in the process than they were before. On the other hand, Jamaica is considered too “rich” for debt relief due to its GNI of about $6500, which, if you’ve ever seen anything of the country outside the resorts, beggars belief. In 2011-12, one-quarter of government revenues were spent on foreign debt payments. There has been a 20% drop in the number of children completing elementary school in Jamaica since 1990 down to 73% from a former 95%.

This is the pattern for the global majority: increased debt, increased poverty, declining services. The IMF and World Bank themselves reported in March that of 68 low and middle income countries (GNI of $12,275 or less):

- 5 are in default on at least some of their debt payments

- 15 are at high risk of not being able to pay their debts

- 23 are at moderate risk of not being able to pay their debt

- 25 are at low risk of not being able to pay their debts

So there are no countries not at risk of default in the world’s poorest nations. Loans are increasing, often to repay earlier loans. Speculative loans are widespread.

The Jubilee campaign does not report on high income nations so here’s some data from a random search of today’s financial media:

- Germany sold bonds for 0.07% annual interest last week. Spain, however, has to pay 6% and is insisting that this is intolerable. Italy sold bonds at 6.504% today. The bonds in my retirement account are making 1.76%.

- Christine Lagarde, head of the IMF, pays no tax on her salary of $467,940 and has a built-in pay rise every year of her contract. Sporting a deep tan, Lagarde last week told Greece “it’s payback time,” arguing that all Greeks had to pay their taxes.

- Facebook founder Eduardo Saverin took citizenship in Singapore to avoid $67 million in capital gains tax, because paying 15% tax is too much for the one per cent.

- Meanwhile law professor Alex Tsesis is quoted in the Times as being “skeptical about the ability of a retail purchaser to be able to play on a level field in the market.” The poor chap lost $2200 on Facebook shares rather than making the instant cash-in “investors” feel entitled to get.

- Told that New Jersey faces a $1.3bn budget deficit thanks to his tax cuts for the rich, Gov. Chris Christie called the auditor the “Dr Kevorkian of the numbers.”

- Russian oil magnate Mikhail Fridman has taken his TNK corporation out of BP: it generated $19bn in dividends to its UK parent since it was created in 2003. Steal oil in Russia, spill it in the Gulf: BP.

- When shareholders vote on executive pay, companies used their block votes so that “less than 3 per ended up losing the votes.”

- Retail sales in Spain are down 11% on the year and a staggering 25% over a five-year period–since the end of the housing boom in other words.

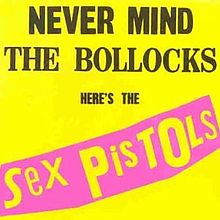

In short, we all need a Jubilee: not a grey-haired German lady taking a ride in a horse-drawn carriage with an irascible Greek aristocrat, but a debt jubilee that returns the financial system to a level of decency. That would be the sensible, NGO-style demand that could be made. But the Jubilee Debt Campaign has been making this case brilliantly for years and the situation just gets worse. No demands. No royals. But I think a quick listen to the Sex Pistols might be in order.