In this morning’s New York Times, there was an odd story about Irish mortgages. It suggested that substantial debt abolition was set to happen but gave very little detail. So I went online to try and find out more and, as far as I can tell, it’s not true. Or, given that there were no details, it’s true that some people in Ireland want this to happen but it’s not clear whether it will. So why was it on page one of the “paper of record”? We can only presume that some people of influence are trying to sow the seeds for debt “forgiveness” as the paper calls it.

In the piece, now not visible on the top pages of the website, Peter Eavis asserts:

The Irish government expects to pass a law this year that could encourage banks to substantially cut the amount that borrowers owe on their mortgages, a step that no major country has been willing to take on a broad scale.

With more than 50% of Irish mortgage holders now underwater and the Allied Irish Bank raising interest rates on mortgages recently, such a decision makes sense. Only there’s no clear indication that it’s actually happening.

What Eavis is referring to is the Irish Insolvency Bill, proposed last June in the aftermath of the Keane report into the financial meltdown in Ireland. Media reports at the time noted that Keane placed

huge store in the implementation of a personal insolvency bill in early 2012.

This legislation is curiously lost in the parliamentary process with no clear account of what’s going to happen being available.

In fact, Irish media reported today the creation of a new joint Irish and UK personal insolvency company, Debt Options, which will be based in Dublin. The Leicester-based firm IrishBankruptcyUK.ie, has been involved in the write-off of more than €1 billion worth of Irish debt in the UK over the last year. Expectations are that more business is to be had because Irish procedure requires expensive legal counsel and a

six-month personal insolvency arrangement process with the bank

Clearly this investment would not have been made if people involved in Irish bankruptcy proceedings thought the government was about to act.

Certainly, debt forgiveness or abolition is in the air in Ireland. Here’s the Irish Independent from September after Blackrock showed that negative equity was at 50% and Moody’s reported that 20% or more of such mortgages would default:

“Principle modification” — which is a nicer way of saying “debt forgiveness” — is, according to Moody’s, the only solution. This has been empirically proven by Blackrock. Thus, we have a known cure that we won’t countenance and can’t afford.

That forgiveness is the answer has also been argued by Harvard economist Carmen Reinhart and backed up by several economists in Ireland, including Oxford’s Ronan Lyons, Trinity’s Brian Lucey and UCD’s Ray Kinsella.

Banks know that even mentioning this possibility is financial kryptonite to their sector. But just look at the figures. Short of mass repossessions, there really is no alternative. The message from the banks is: “Stay calm, don’t worry, this is under control.”

Quite frankly, our banks have been lying to us. This is about as controlled as herding butterflies.

Well put. So we have to conclude that the Times put this story on A1 because it too wants to put pressure on the banks. Who pushed them to do that? The only conceivable “source” that might have such clout would be the Federal Reserve or similar high placed financial regulators. Debt activists have been hearing rumors for a while now that debt abolition is on the Fed’s agenda.

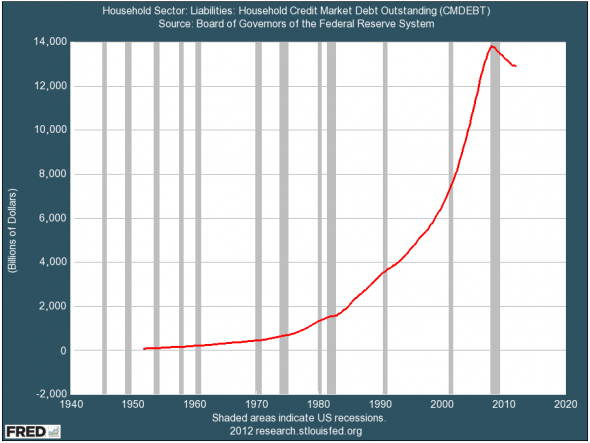

Mortgages are $14 trillion. The earth may be moving under our feet.