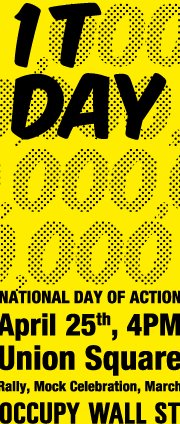

At the time I began writing this, I should have been at the Occupy Student Debt march to mark 1T Day, the day when student debt crossed the one trillion dollar mark. Instead I was in an airport waiting room, watching cable TV and thinking about the Jubilee. It turned out to be a good place to spend 1T Day after all.

According the Wall Street Journal, a trillion dollars of student debt may have happened as early as February. The Federal Reserve Bank of New York put student debt at $870 billion in December 2011, so it must be close. But no-one really knows.

Instead of participating in this day of action, I was waiting for a delayed plane that was at first said to need “cleaning.” This process went on and on, until United admitted that they could not clean the plane. It became clear that a vast malfunction of the toilet system had, well, covered the plane in shit.

Instead of participating in this day of action, I was waiting for a delayed plane that was at first said to need “cleaning.” This process went on and on, until United admitted that they could not clean the plane. It became clear that a vast malfunction of the toilet system had, well, covered the plane in shit.

Sitting there with my copy of David Graeber’s Debt, it seemed to me that this plane was a metaphor for the financial crisis itself. This system, in which our duties are to “sit back and relax,” while under the restraint of keeping your “seatbelt securely fastened,” promised to function invisibly, magically shrinking distance at ever-reduced cost. Instead, fossil fuel use has destroyed the atmosphere, corporations cannot successfully manage to privatize what should be a public system, and we have all been literally and metaphorically sprayed with their effluent.

In my waiting room haze, I mused that this spray was given literal form by the BP oil disaster in the Gulf, which has recently been shown to be caused by the oil company’s excessive greed for profits, in the just the way that you always knew it had been. The repellent John Brown, former CEO of BP, ordered his staff to

Go to the limit. If we go too far, we can always pull back later.

So that’s all right then. Browne then went on to cover himself in further glory by heading the Browne Review of higher education in the UK, which argued for the end of limits to tuition fees. The result has been that education that was provided to me freely is now being charged for at £9000 a year (about $16,000)–reasonable by some US standards perhaps but the upward acceleration is so dramatic, you have to wonder where it ends. Corporate profligacy is rewarded by the ability to recommend individual austerity. Or simply put, big oil creates student debt.

As I waited, I heard the phrase “student debt” from the TV. CNN was covering Obama speaking today at the University of Iowa. He revealed that he and Michele had only managed to pay off their own student debt in 2004, at the time he became a US Senator. The students cheered wildly, although I’m not sure why: because Obama was therefore like them? Or because they could imagine emerging from their indebtedness to become a Senator or a President? It’s telling that Obama made this speech at a land-grant public university. Until very recently, such institutions would have been low-cost or free, especially for in-state students. The University of Wisconsin, where I was just visiting, had a 5% tuition raise this year as the icing on the cake of another round of serious cuts amounting to $250 million.

Obama gave a good soundbite but the change he is advocating for is trivial. He is calling for interest on Federal Stafford loans to remain at 3.4%, rather than doubling to 6.8% as they are set to do this July. As the money comes from the Federal Reserve, whose prime rate is next to zero, this still represents substantial exploitation of students and their families. Indeed the objection is the “loss” of revenue, entirely notional in any event, which amounts to a rounding error in the Pentagon budget. It’s not going to happen in a Republican-dominated Congress anyway, it’s just a bit of electoral theatre.

As Graber says at the end of his book, what we need is a debt jubilee, meaning a cancellation of debt, as called for by the Bible, which is always right in America, except when it benefits those who need debt. Sitting there in the airport, I reflected that like most airlines, United has been through bankruptcy, as American Airlines currently is doing. Unlike personal bankruptcy, such corporate bankruptcy is very rewarding. The company gets to restructure its debt, reduce its obligations to its workforce, and increase costs for its customers. These bankruptcies brought you things like baggage check charges and no food on planes, while reducing salary, benefits and pensions for airline workers, putting them, no doubt, in debt.

So, like George Costanza, we need to do the opposite: cancel debt for ordinary people. Create more jobs by turning the airlines, subways and railroads into a sustainable, integrated low-cost public transport system. Reduce the retirement age so employers need to hire new staff. All financed by taxes on financial transactions and increasing taxes on capital gains to the same levels as income. Impossible demands? Maybe. But when Occupy Student Debt was established six months ago, we weren’t having a national discussion about reducing student debt and now we are doing. Let’s see where we are in six more months, shall we?

Pingback: MORE THAN 1 TRILLION OWED NOW–Refusing student debt serfdom is indeed part of a larger anti-capitalist struggle. Recently, in an open forum on the debt-prison system, we were reminded that debt was central to slavery in early America, for many slave