This is not a headline I expect you will see in many US papers tomorrow, which will be consumed with whatever gaffe, zinger, or body language is supposed to have determined the “debate.” Sadly, facts and ideas have no place in these bizarre performances that increasingly revolve around the unspoken axis of racial tension.

Meanwhile, it has become clear that the austerity policy of our global hegemons is a failure even on its own terms. The Eurostat agency today reported on the economic condition of the Eurozone and the full membership of the European Union. Short story: despite a minimal decline in budget deficits, government debt is up all over the region.

Details:

• Eurozone government debt: €8.22 trillion in 2011, up from €7.833 trillion in 2010

• Eurozone debt/GDP: 87.3% in 2011, up from 85.4% in 2010

• Eurozone deficit: 4.1% of GDP in 2011, down from 6.2% in 2010

• EU government debt: €10.433 trillion in 2011, up from €9.826 trillion

• EU debt/GDP: 82.5% in 2011, up from 80.0% in 2010

• EU deficit: -4.4% of GDP in 2011, down from 6.5% in 2010

It’s interesting to note that the budget deficit in the U. K. is almost as high as in Greece and Spain at 7.8% and fourth highest in the EU overall, yet there are no urgent IMF missions to London, presumably because the Old Etonian government there is already sufficiently hostile to benefits and social investment. Even Germany exceeds the ridiculous target of state debt being 60% of GDP as if this number had any bearing on reality.

However, the Franco-German leadership of the EU has hinted to Ireland that a “retroactive recapitalization” of Irish banks to the tune of €64 billion may be forthcoming–but no promises. This is the “reward” to Ireland for being a model for how to accept austerity so as to save banks over people. Strangely, the Irish, suffering through mass unemployment, recession and collapsed housing markets, are still not celebrating.

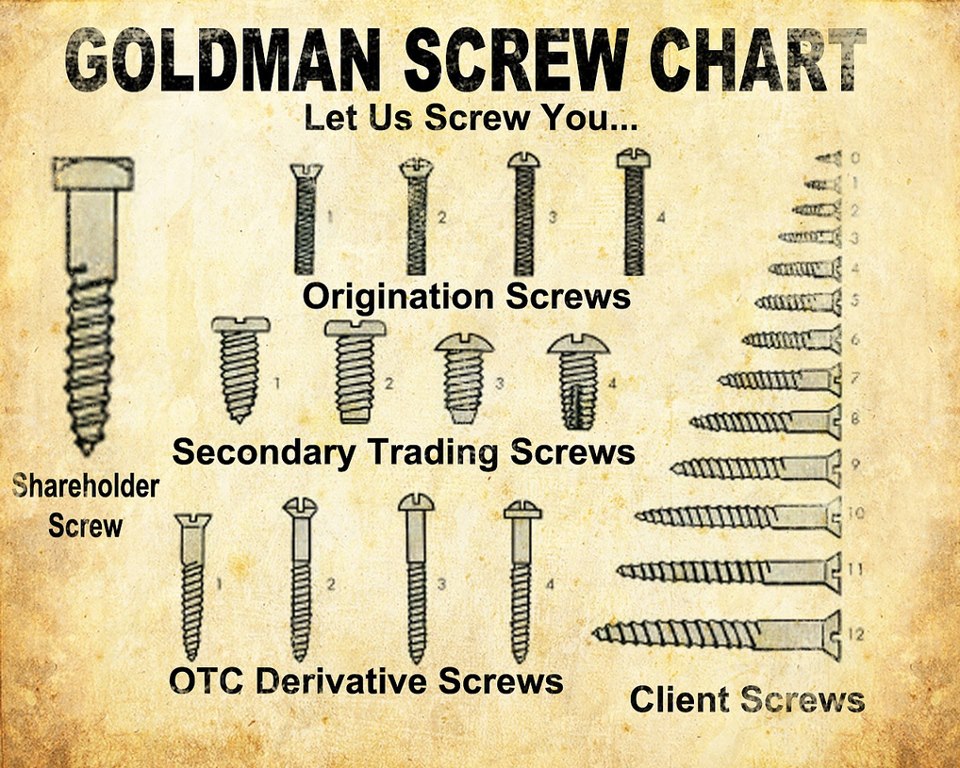

In the vocabulary of Goldman Sachs, we are all “muppets,” unsophisticated clients who do not realize how even apparently beneficial deals being presented by the bank in fact generate high levels of profit for the lender. It is some kind of final acting out of hostility that the one clear commitment made by the Republican candidate has been to abolish Sesame Street and its muppets.

In more news you won’t have heard, a group of occupiers has set up a new Occupy outside the residence of Lloyd Blankfein, the CEO of Goldman Sachs. The action follows the O13 mic check at 15 Central Park West, where Blankfein lives. Although there was one spurious attempt to evict them by claiming that the sidewalk was in fact in the park, although it is clearly on the far side of the avenue from the park, the small group of occupiers have held on for several days so far.