One way of thinking about debt is spending the future: a debt incurred today must be repaid with future earnings. In planetary terms, mining places us all in biosphere debt. To open a mine is to guarantee further primary extraction, incurring high energy use, new carbon emissions, destruction of the local environment, atmospheric and water pollution. It further sets in motion the commodity production process because new minerals will become new cars or girders or an iPhone. In short, any chance at moving away from neo-liberalism would have to begin with a slowdown or even cessation of mining. At present mining companies are all trying to expand, while also reducing still further their labor costs. It will take a co-ordinated global movement to push back.

Last week the transnational steel giant ArcelorMittal finally closed its Florange steel furnaces in France, having waited out the French elections and the Olympics (where ArcelorMittal was a major sponsor). 700 jobs were lost with the usual knock-on effects that such retrenchment entails. As in 1981, the Socialist administration is discovering that its room for maneuver is far more limited than they expected.

In South Africa yesterday, the Anglo-American Platinum corporation resolved a three-week strike by firing 12,000 workers. The standard pattern sees the company then hire back a fraction of its former staff and reduce output. At present, world platinum prices have recovered from their low-point of August, to 2011 trading highs of about $1700 an ounce, still far below 2008 levels of $2200. More than enough to pay the salary being demanded by the miners which, at 15,000 Rand is ironically about $1700, the price of a single ounce of platinum. Too much for Anglo-American. In a country where people are desperate for work, firing workers that have become militant and replacing them with a totally different workforce is an acceptable option.

Xstrata, the world’s largest extractor of thermal coal, is still trying to merge with a financial company called Glencore in a $32 billion deal. The Glencore-Xstrata merger is unusual in that it brings together financial capital with primary extraction in the same company:

Xstrata is very good at operating mines efficiently and at low cost, without upsetting local communities. Glencore is not.

But it does boast a global network of commodities traders who possess unrivalled intelligence on global demand trends that theoretically allows them to make money at any stage of the commodity cycle.

This will create what corporate-speak calls a “vertically-integrated” company. In fact, it will amount to a dramatic change in philosophy. Xstrata is a greedy, play-it-safe company that works cosy, inside deals in countries that are considered “safe,” meaning pliant to neo-liberal market world views. Glencore, according to business journalist Nils Prately, are altogether more aggressive:

The Glencore thesis is that the best returns come from extending so-called brownfield sites and that the political risk that goes with investing in places like the Democratic Republic of Congo is tolerable.

Translated into English, this means that expansion in under-regulated, low-wage regions is considered worth the risk of political upheaval. This is not to say that Xstrata are not in favor of biosphere devastation.

This August they won approval from the Australian government to convert an underground zinc mine into a massive open-cut operation in Northern Territory (above). It’s just that they like governments who can be relied on to jump to the precise height required with no foreseeable risk of change.

Ironically, it’s being held up not by concerns about the disastrous biosphere impact but about the egregious payday (even by Wall Street standards) that Xstrata management lined up for themselves. Merger and retention bonuses (cash for showing up on Monday to do the job you had on Friday) would amount to a whopping $233 million. Shareholders are now getting to vote on the compensation deal but the big investors like Qatar’s sovereign fund are now behind it.

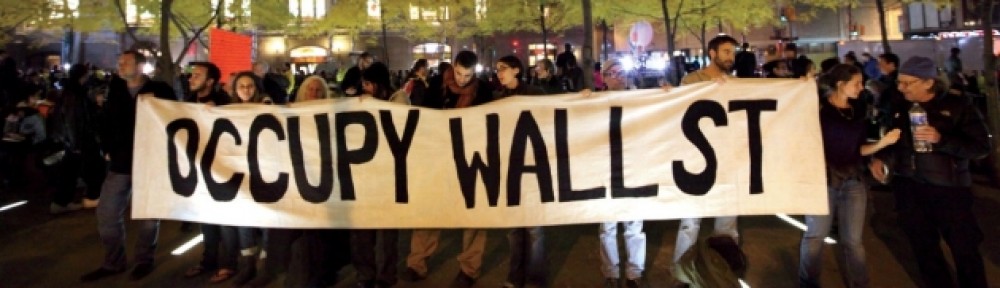

So we can see that neither shareholder activism, as in the Glencore-Xstrata merger, or strikes by workers as in France and South Africa, have been able to restrain multi-national mining.

In Texas beginning on September 24, a group of activists have taken to the trees to prevent the Keystone XL pipeline from being completed. This pipeline is being built to bring the “carbon-bomb” of Alberta’s tarsands oil to the Gulf coast. If you look at the clear-cutting and construction going on, it’s hard to imagine that a “decision” seriously remains to be made after this kind of expenditure. After November, whoever wins the elections, this pipeline will be authorized. The Texas activists, like their predecessors in the logging struggles in Washington State, have taken to the trees.