For a long time, Occupy was a combination of radical affect, method and principle. It did not have a central subject. Readers will have noticed that debt has increasingly become a key theme in this project. And now it’s perhaps becoming the theme in OWS as well. A growing consensus is emerging that the next major day of action will be orchestrated around debt. This will be Black Monday, or September 17, Occupy Wall Street Year One.

In a sense, this is overdue. After all, OWS’s own David Graeber is the author the global best-seller Debt. But just as the 2011 protest lagged behind the worst of the bailouts, it’s only now that the full extent of the debt crisis is becoming apparent.

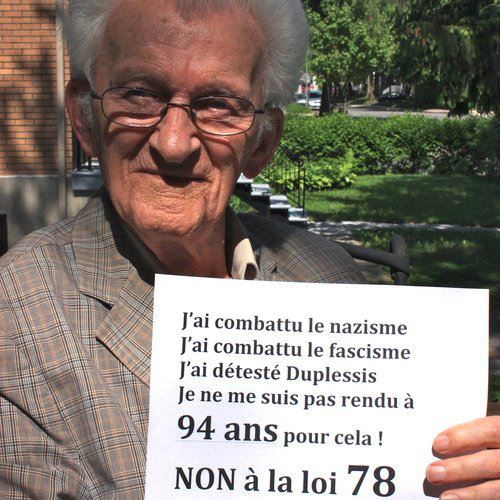

There are three main factors at work here. One is the exemplary resistance in Montreal to the privatization of higher education and the refusal of endebted futures. Here is a direct challenge to the idea that morality means debt. Quebecois consider that they have already paid for education via direct and indirect taxation, one. And, two, they see a moral society as one that educates its citizens as a public good.

“I fought nazism. I fought fascism. I detested Duplessis. I didn’t make it to 94 for this. NO to law 78.”

Next, and perhaps resulting from this rigor, is the new refusal of student debt that I’m seeing. I’ve met several graduates who are talking about going directly into default from graduation, confronted with apparently long-term unemployment. Many others have moved home with family to a very different future than the one they envisaged when matriculating.

Finally, the macro-economic picture continues to worsen. Spanish banks can’t even calculate how much bailout they need. And this, incidentally, is one of the many reasons why the parallel between family budgets and financial institutions doesn’t work. If the EU came to me with an offer to bailout my debt, I could work it out in about half an hour. Yet giant Spanish institutions with highly qualified staff offered a spread of between 20 and 62 billion euros. So the real amount needed is probably 120 billion.

Major US banks had their credit ratings cut on Thursday so that Citigroup and Bank of America are now two notches above junk bond status. The only upside for their customers is that these banks have so maximized their fees and penalties already that they have run out of room for more.

In his European travels, David Graeber has been saying that the question now is, not if there will be some form of debt abolition, but how it will happen. In Iceland, the state has decided:

to forgive [mortgage] debt exceeding 110 percent of home values.

This forgiveness has affected between 15 and 20% of mortgages to a cost of at least $1.6 billion (in a country where the population is only about 300,000) and has had a dramatic turnaround effect on the economy.

Here banks have moved to a new tactic to their own benefit alone: short-selling, in which a house is not formally foreclosed but the bank accepts a sale at a loss. A striking 233,000 homes were sold this way in the first quarter of this year, a quarter of all such sales. That’s a million people who have had the banks sell their homes for them. Thus the headline-making foreclosure sales are technically down, at just over 20% of the market. Banks still own nearly 700,000 homes and the same number are in some stage of foreclosure: over 5 million more people are confronting homelessness.

The housing crisis is an invisible reason the student debt situation has worsened, I suspect. Parents and other financial supporters no longer have home equity to draw on to sustain ever-rising tuition costs, as universities assumed they did until 2008. That’s me right there.

And next week the Supreme Court is going to overturn health care, which, as flawed as it is, represented at least a chance that medical debt might be contained. In today’s New York Times, a couple with two health insurance policies are reported to have found themselves with a $90,000 bill after a fall led to an unexpected set of surgery and nursing home stays. A consultant reduced the costs by $22,000–but charged 25% of that as a fee.

So when the Montreal solidarity march last night took the theme “Night of the Living Debt,” it really made sense to people. It might as well be zombies spreading the debt crisis because it would be no more out of control than it is now.

Today, a group called “Free Bed-Stuy” had a great Free University-style event in a lovely park in deepest Brooklyn (I forgot to take pictures because I was doing a teach-in). An urban farm next door housed chickens, pigs and vegetable plots: and also a serious sound system that was luckily far enough away from the event that we could hear ourselves talk. No cops. And a comfortable curious crowd, who were eager to hear our ideas about linking debt to prison, slavery and stop-and-frisk. Tomorrow, the fourth Strike Debt assembly in Washington Square Park, 12pm. I’ll report back.

Thank you for all of your educating, efforts

and perseverence in these changing times.